If you are a transporter who owns fleet vehicles, reducing fleet expenses should be your first priority. However, fleet managers also need to be aware of the vehicle operating costs involved. The route and expense budget for the business, as well as data analyses of productivity and revenue, all depend heavily on fleet expense analysis. It is critical to understand the cost per kilometer that each vehicle travels.

The best method to make data-driven decisions to maximize profitability is through fleet expense analysis. It is simple to track expenses and centralize the data when using software. Fleet managers will benefit from fleet expense analysis and get a realistic perspective on budgeting and profitability. It will also help them run their transport operations more effectively if they have optimized and regulated costs. Today, as part of our blog series on fleet manager reports, we'll start with a discussion of how to analyze fleet expenses effectively and efficiently.

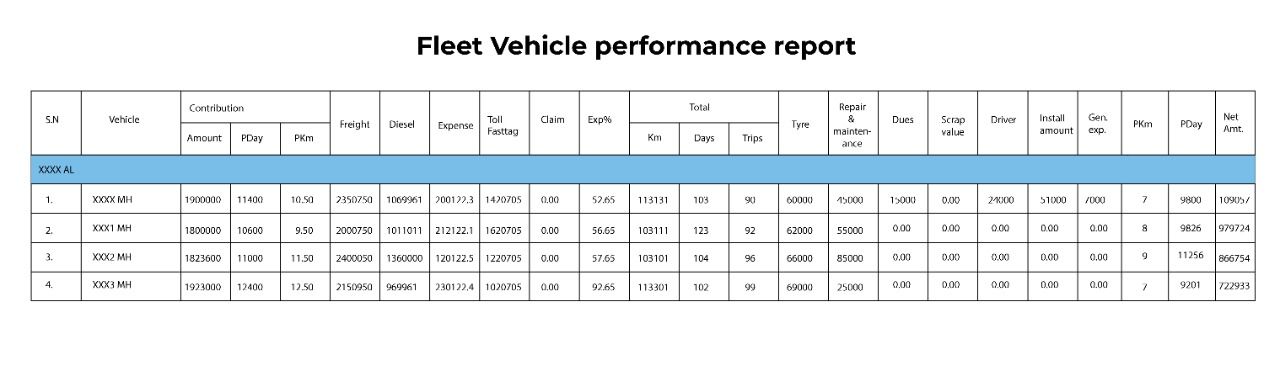

In any business that deals with import exports and transportation, vehicle performance is the most crucial thing because it provides an overall picture of what's happening in the company and provides overall visibility of the vehicle. But having the vehicle performance data has many steps; it is a combination of various processes that we are going to discuss today in this blog. Before starting, it is important to note that the expense cost structure is divided into two parts: direct expense and indirect expense.

Direct Expenses

Analytical report: If we start talking about vehicle movements or trips and look at a defined vehicle and how many kilometers it has covered, then the kilometers traveled by it can be measured by three parameters, and these three comparisons are calculated in the following way:

- The difference in odometer readings from the beginning to the end of the journey

- Route planned distance and configured total distance traveled during the travel period

- GPS device value for total distance traveled.

The measuring parameter is chosen by the fleet managers according to their requirements. Once in a month, fleet owners check the three different parameters and compare them. This is called an analytical report, and if there is a minor variation in the report, it is manageable, but if there are more, action should be taken for the inaccuracies as it leads to expenses.

Running-based expense report: A running-based expense report depends on many factors, but here are four reasons listed that are common factors for all the expenses in a business.

Loaded and unloaded trips: There are two types of trips: loaded trips, in which trucks carry cargo, and unloaded trips, in which trucks travel empty. In defined kilometers, the number of trips the vehicle has completed accounts for income and expenses. The expenses and income are calculated according to the number of loaded and unloaded trips made. If the unloaded trips are more than the expected number, then the management has to take action to reduce them.

Vehicle Model-Wise: Vehicle efficiency increases the revenue directly. If the vehicle model is good, it tends to perform better, which helps in saving costs. Also, a better vehicle model requires less maintenance and provides better features.

Driver Wise: All vehicles must cover a certain number of kilometers per day according to a given benchmark; if they exceed that, the driver should be rewarded; otherwise, they should be penalized if they do not meet the benchmark. This impacts the driver's performance and accounts for vehicle expenses.

Driver Group Wise: There are defined areas where the drivers are efficient. The company should know who they can rely upon and they should select a group of drivers who are capable of giving on-time deliveries and who follow ETAs. On the other hand, companies should also examine the drivers who are exceeding ETAs. They should perform a proper analysis of quarter-wise driver performance, driver shuffles, better driver recruitment, and bad driver removal. Decision-making according to the driver's past experience is important for saving costs.

Business expense: Expenses can be incurred in the revenue according to the trip route, region, destination, and vehicle model. We can determine which regions are profitable and which regions require more attention by analyzing revenue.

When there is no deduction in the cost, the amount of freight that is safely and timely delivered is revenue for the company; however, if there is a loss due to any factor, management must calculate why and where the deduction is.

Market vehicle expense: There are two ways a vehicle can be used: one by leased, and the other is own vehicle. With the report and the data, we can analyze which type of vehicle is profitable for the company and know the estimated expense that can occur. For instance, if in some states, businesses can't afford the availability of their own trucks, then they can go for leasing trucks in that region which can help them in saving the cost of the long trips, fuel, driver wages, and maintenance expenses.

Trip and miscellaneous expenses: When moving materials from one place to another, expenses like delivery charges, fuel, challans, toll expenses (cash or FASTag ), and miscellaneous charges etc. , all of these are counted as expenses. Companies can use the data to conduct regional analyses by comparing trip expenses of different regions. Some fleet managers add fuel and toll taxes to their expenses, and some do not.

The budget is determined when planning a trip, and once the results are in, we can analyze the expenses and try to reduce them. While planning a trip, an estimated amount of fuel (CNG, diesel, or gasoline) is decided, and based on a defined average, the fleet owners record the budget vs. actual fuel requirement and then come to the conclusion that they are at a profit or not. All the expenses are calculated and compared to the estimated expense.

Indirect Expenses

The vehicle is not as closely tied to indirect expenses and doesn’t account for leased vehicles. They are generic business expenses that we cannot immediately link to a specific vehicle because they serve the needs of the entire organization. We have covered some general indirect expenses that a fleet manager deals with on a regular basis.

Tyres: Trip expenses such as tyres, scrap tyre exchange, and torn tyre tread are indirect expenses. The scrap value of the tyre adds up in the company's account, which is why it is important to keep track of how many times tyres are changed and sold.

For instance, if vehicle 1 tyre works for 3 months and it breaks down and tyre 2 is put on from stocks and the old tyre is sold, then the income will be indirect income, and in a calculation, if we consider the tyre value to be ₹15,000 but we get ₹500 back when it is sold, then the expense will be considered to be ₹14,500.

Repair and maintenance: Repair can be done in two ways:

- In-house maintenance: It is carried out on company premises where a workshop has been established and the work can be completed using company resources.

- Outsource maintenance—work is done outside, and repair work is outsourced.

In both cases, the repair expense is different. The company must determine the best repair method for each piece of equipment. Clients follow both practices because not all the maintenance equipment is available in companies and because it can be easily done by outsourcing.

Fleet owners can calculate generic or routine maintenance costs, en-route maintenance, accidental maintenance, and capital investment (purchase cost of the vehicle, modification cost, new vehicle accessories to bring the vehicle on the road, body changes based on the client's needs or government norms) using fleet expense data analysis.

If the cost of maintenance is significantly increased by an accident, then fleet owners need to take action against the cause of the accident.

General expenses: General expenses are not part of the above-mentioned expenses; they can be anything like staff salaries, office expenses, or the EMIs of vehicles owned and documentation (If documentation expenses are high, then in the report we can check and compare other agents' expenses); the deduction of such expenses from revenue results in the deduction of net profit of the company. Net profit can be calculated on a daily, weekly, or monthly basis, depending on the vehicle.

Through reports, we can see which areas are costing more and where companies can save money. If general maintenance costs are high, it’s a challenge for the companies, and this cost can be used to check the flow of expenses.

Conclusion

When we examine fleet expense analysis reports, we can see how costs are allocated to various areas such as maintenance, routine maintenance, spare parts, repairs, capital cost, and per km vehicle cost. When we check vehicle costs region-wise, we can optimize by analyzing the flow of expenses from different regions. Stay tuned for the upcoming blog on other steps of fleet manager reports.

What is fleet analysis?

Fleet analysis is one of many reports in Fleet reporting. With this report fleet managers slice up expenses incurred on the fleet in a particular quarter, 6 months or in a year and optimize least performing areas i.e Fleet maintenance, Running Km, Driver performance, etc.

What is fleet forecasting?

Fleet forecasting refers to different aspects like forecasting service reminders on X km or forecasting revenue during job planning. Forecasting fleet jobs in a traditional manner is changing with the adoption of fleet management software.