The petroleum industry is one of India's eight key industries, and it has a significant impact on all other critical sectors of the economy. As a result, the performance of its supply chain has become critical. The petroleum sector has a global supply chain that comprises domestic and international transportation, ordering and inventory visibility and control, materials handling; import and export facilitation; and information technology. As a result, the sector seeks the finest model of supply-chain management strategies.

The government of India has historically set prices in the petroleum business. The government implemented a revised approach on August 1, 2004, allowing oil firms to modify the pricing of motor spirit and High Speed Diesel (HSD). During the next eight to ten years, India's oil and natural gas sector is expected to receive $206 billion in investment.

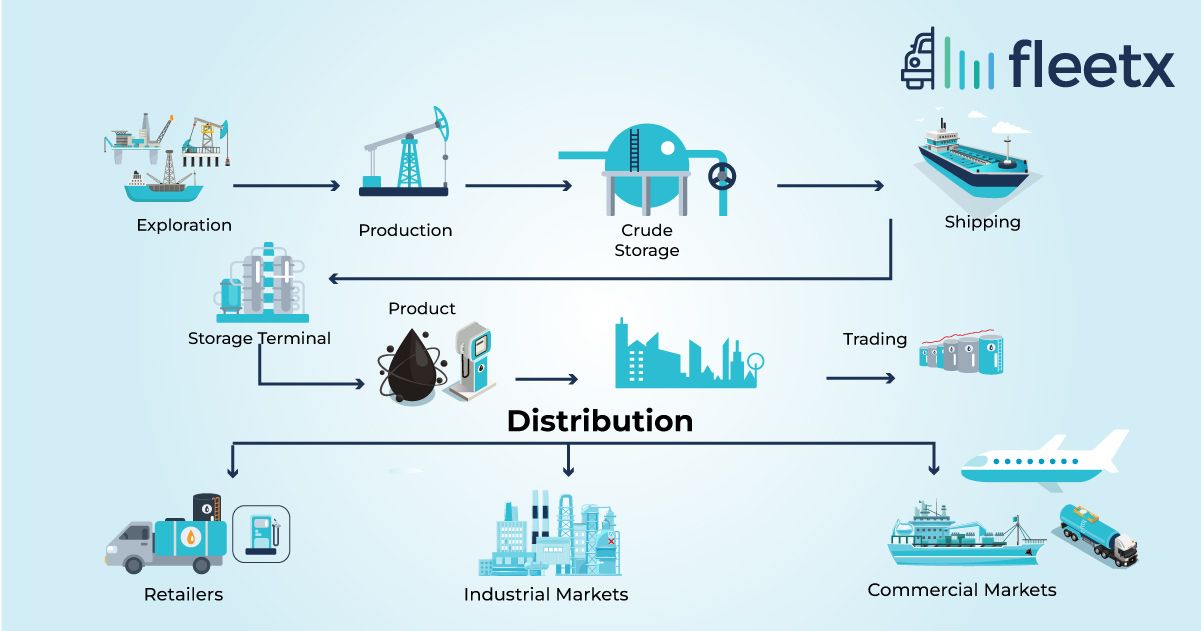

Petroleum is a needful thing for human civilization in many ways. It fuels and lubricates the millions of engines that move people all over the world, it helps in heating and lighting; it contributes to energy generation; and it's a major raw ingredient in a wide range of products. Unfortunately, procuring and carrying out all of petroleum transportation and distribution activity is a huge technological and logistical issue. Even after extracting petroleum from deep under the ground, the difficulty of getting it from the oilfield to its eventual destination persists. Transporting crude oil and petroleum products remains a challenging and often risky proposition. This complex technique needs an effective supply chain management approach.

The petroleum industry's supply chain management presents unique issues, particularly in the logistics sector, that are not seen in most other businesses. These logistical issues have a significant impact on the price of oil and its derivatives. The petroleum sector is very asset-heavy, and the performance of its supply chain may account for its total cost. However, there are still chances for cost savings in logistics. The giant oil and petrochemical industries are automating the procedure that will save them millions.

Petroleum supply chain management challenges

Complicated operations: The logistical process is highly extensive and coordination is progressively more difficult in the petroleum industry. Businesses should rapidly realize that they must handle and understand lots of data each day if they want to enhance procurement and supply chain management for the petroleum sector. Extreme amounts of power are required to make sense of the data, but it also has to be monitored and analyzed by specialized staff. In the absence of such data, businesses would never be able to develop sustainable oil and gas procurement strategies that enhance business operations. With the help of AI and technology, the work can become easy to assist, organize, process, and evaluate the data that is received every day, and it is the best approach to handle this difficulty. Once adopted, this will assist businesses in avoiding time-and resource-consuming information backlogs that obstruct company flow.

End-to-end visibility: There is a delay between information available to managers in the offices and activities on land or at sea. The supply chain for petroleum is not always the most open. Only a small number of nations produce the majority of the petroleum used by most companies . When there are shortages in such nations or other economic problems that affect the flow of the supply chain, it affects the domestic oil and gas supply chain and procurement procedures. Making the supply chain more transparent is the best strategy to solve the industry's supply chain procurement problems. Keep track of daily costs; search for alternate sources, and monitor risks abroad.

Fragmentation: Fragmented supply chains are the result of the large number of stakeholders, drilling locations, and countries, which makes it difficult to see the materials. As the supply chain breaks up, it is harder to keep track of all the pieces. Because of supply chain division and fragmentation, decision-making and implementation become laborious tasks. Instead of wasting time on data processing, the simple solution is to use technology to keep track of everything in one location so that it is easier to handle.

Market Unpredictability: Market concerns about oil production interruptions, petroleum supply chain issues and uncertainty about combat inflations, these market concerns contribute to the prices of oil and petroleum products. There comes unpredictability in the petroleum supply chain , which is undesirable as a result of the existence of several stakeholders, data management issues, material monitoring and fluctuating prices.

Oil Tanker problems: Volume is everything when it comes to carrying oil and petroleum-based goods. Even if oil tankers are the best option, all that volume might be a big problem in the event of a disaster. Barges or tankers have been engaged in many of the greatest oil spills in history, which have had significant negative environmental effects on delicate rivers and weak coastal regions. Even though the volume of these spills is frequently tiny, their frequency has a large overall impact. Spills can also occur as a result of breaches or accidents affecting smaller vessels. Finally, barges and tankers may only be used to move goods to and from locations that are close to large river systems or coastal seas, so additional transportation options are frequently still required to complete the journey.

Driver safety problems: Long hours are possibly the worst enemy when it comes to driving safety problems. The same highway safety regulations that apply to truck drivers do not apply to oil field employees. While there is a daily restriction for truck drivers, there is none for oil field employees. For 7 to 14 straight days, they could perform shifts that last 12 or 13 hours or longer. Even the Centers for Disease Control and Prevention acknowledge that by requiring an excessive number of hours of service, these "oilfield exemptions" foster an unhealthy workplace.

Because of the exhausting work environment created by those long hours, it is not surprising that driver fatigue is the main factor in accidents in oil and gas trucks and tankers. Shift work and irregular, lengthy hours are dangerous. It has been found that shift workers are more likely to have insomnia and daytime drowsiness, which both raise the risk of work-related accidents, including. Additionally, trucks frequently travel through dangerous places like crowded roads and urban neighborhoods. To keep up with demand, the number of vehicles on the road must increase rapidly due to the limited capacity that trucks can transport. This damages the ecosystem and local air quality while also raising the likelihood of accidents in the area. Truck transportation may potentially become safer and more effective with the implementation of stricter safety regulations and a push for greater driver training.

Changing demand for petroleum: Despite being one of the more stable global businesses, the petroleum sector nonetheless has ups and downs. The demand for oil and gas will continue to decline as more individuals choose to work remotely or from home instead of making the typical commute to the office. As a result of this shifting demand, the oil and gas procurement process has to be more dynamic. You can meet those changing demand levels without losing money by monitoring the demand and modifying your supply chain as necessary. Having supply chain analytics in place will allow you to anticipate periods of low procurement and rises in demand without having to make changes manually.

Conclusion

Adopting technology that is intended to assist in simplifying operations and decreasing backlogs in data interpretation is the easiest method to enhance the petroleum procurement process. By doing this, you'll modernize your company and be able to automatically solve many of the most common procurement problems.