What is an E-Way Bill

An E-way bill is a mandatory pass for movement of goods exceeding the value threshold as specified by the government. In India the specified value is 50,000 INR. It is applicable for both interstate and intrastate movement.

The validity of an E-way bill depends upon the distance to be travelled.

- One day for the initial 100 kilometers.

- One day is granted for every additional 100 kilometers.

Non Compliance of an E-way bill can lead to penalties & even confiscation of vehicles & goods.

How an E-way bill is generated

The E-way bill is generated through the GST portal or via message from transporter, supplier or recipient. To generate an E-way bill, following information needs to be provided.

- GST of the supplier & recipient.

- Place of delivery

- Invoice or challan number.

- Date

- HSN code

- Value of goods

- Transporter Details.

What are the Benefits of an E-way Bill

- Controlling Tax Evasion: An E-way bill makes sure that all the goods in transit are properly taxed.

- Increased Transparency & Visibility: With E-way bill you can increase transparency and visibility in your supply chain operations.

- Uninterrupted Movement: An E-way bill simplifies the movement of goods interstate and intrastate by reducing paperwork & regulatory bottlenecks.

How Fleetx removes the hassle of E-way bill extension

An E-way bill is valid for one day for 100 kilometers. For every additional 100 kilometers, the validity of the E-way bill is extended by one day. Failing to extend it may cause many compliance based interruptions & penalties during the movement of goods.

Manually extending the e-way bill for multiple trips can be time consuming and error prone, but with Fleetx E-way bill integration you may never have to worry about extending an E-way bill again.

E-way bill expiry notification

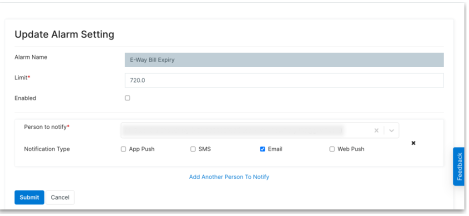

For users who still want to manually extend their E-way Bills, we provide a solution of generating alarms and notifications to remind the users about their Eway bills which are expiring soon.

- Users can enter the Eway-Bill numbers in either the job or consignment module either via UI or via bulk uploaders.

- Clients can select the users who should get these notifications and before what time of expiry to get the notifications.

E-way bill auto expiry extension.

- You can completely forget about manually extending your E-way bill expiry.

- For all the active trips, system will check the Eway-bill validity date from the gov-eway-Bill portal using the API credentials provided by users

- If the validity date is of the same day, the system will extend the E-way Bill validity by 24 hours.

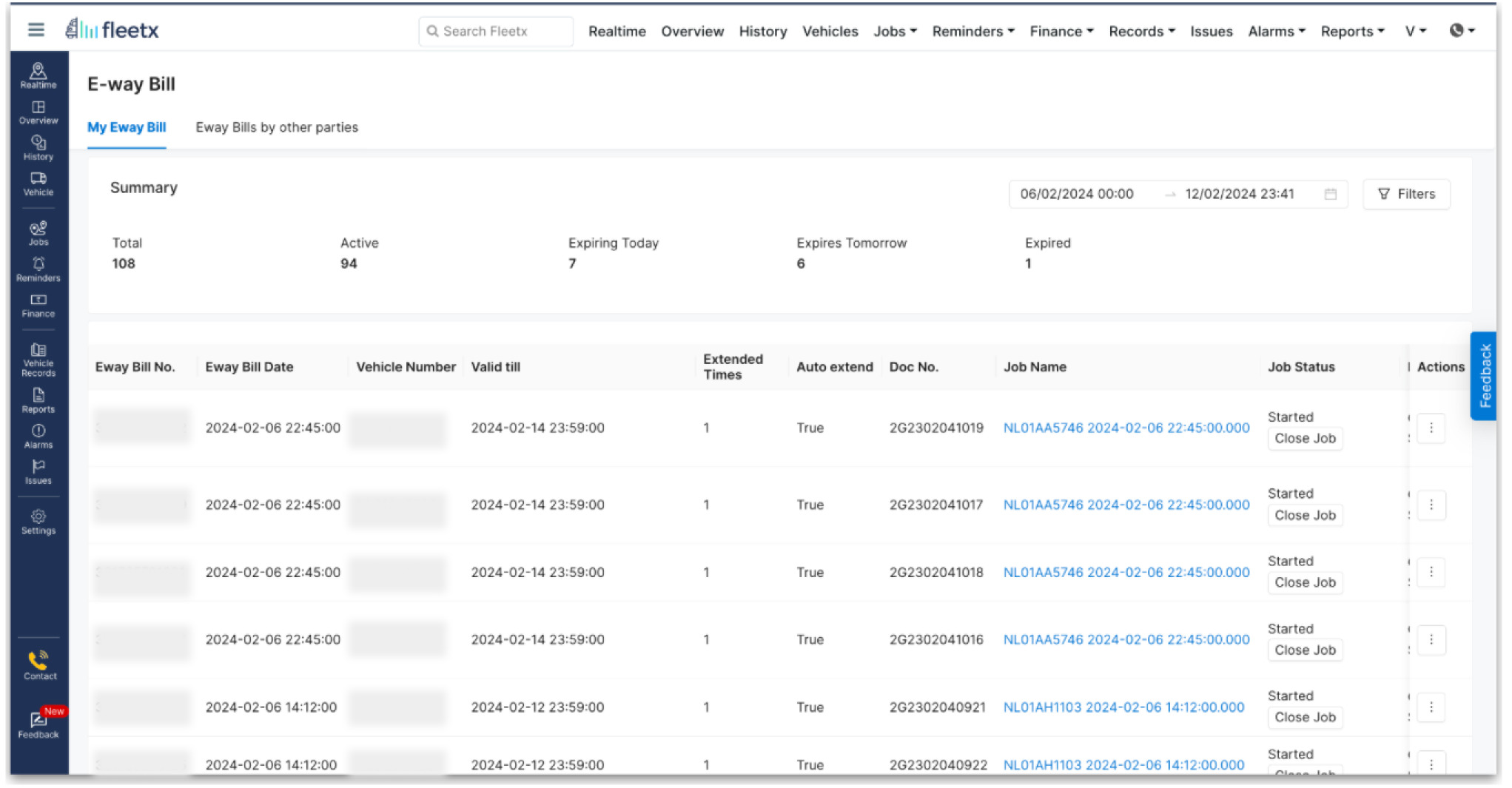

- Users can check the list of eway-bills mapped to the jobs in the Fleetx Eway-Bill dashboard.

You can also create trips automatically from E-way bill

- Remove the hassle of creating jobs, Fleetx will automatically fetch the E-way bills assigned to the transporter and create job against them.

- In the dashboard user can see the job created against E-way bill and track the vehicle in real time.

- Users can close the job from the same page.

You can check E-way bill summary & filter them as required.

- Users can see the total Eway bills assigned for which jobs are created.

- They can see the validity based classification, Expiring Today, Expired and Active(Expire after tomorrow) and Expired

- You can filter out the list based on these classifications and also vehicle number, consignor etc.

E-way bills have simplified the movement of goods with the state and across state borders. With Fleetx you can relax and focus on your business, without ever worrying about a missed E-way bill auto extension.

9 out of 10 of our customers do not remember when they last updated an E-way bill manually or missed an extension.

Contact Us for a free Demo.